How to Estimate the Size of a Market

Let’s talk about how to estimate the size of a market, also known as market sizing! Why would you want to do such a thing? Well, maybe you are pitching your awesome business idea to a venture capitalist. You’re not? OK, maybe you work for a big company and you want to convince the management team to pursue your fantastic product idea. Still no? Ok, well maybe you are a student and you need to pass a test, or maybe you are simply into learning new skills. Whatever the case, let’s dive in and learn how to estimate the size of any market.

Summary (aka tl;dr)

Market sizing is the process of trying to figure out how big a particular market is (in terms of $). There are two primary methodologies to do this: bottom-up and top-down. Bottom-up is simply the # of units X the price of one unit. Top-down looks at the size of a larger market that includes your market, and then tries to carve out the relevant piece. That’s the gist of it, but read on!

Defining the Market

The first, and perhaps most important, step in this process is to define our market. Don’t skip ahead! It is really important to get this step right.

So, before we get into bottom-up vs. top-down, TAM, SAM, SOM, and all that stuff, let’s start with three basic market definition questions:

- Who’s the buyer?

- Who’s the user? (yes, it can be different from the buyer)

- What is the scope of my market (geographically and/or demographically)?

Market Sizing Example:

The Market for Coffins in the United States

The best way to illustrate all of this is through an example. Our example is going to be a little weird, but interesting. Here’s the situation: you are a stellar woodworker of cabinets and you are thinking of expanding into the coffin business. Before you get into it, you want to know the market size for coffins in the United States. First, you define your market:

Who is the User?: Deceased humans (and vampires)

Who is the Buyer?: Families of loved ones who recently died

What is the Scope of my Market?: All demographics across the entire United States

See how the buyers and users can be very different? This happens more often than you’d think. In market sizing, we will focus mostly on the buyers. By the way, let’s ignore vampires from here on, since that’s such a niche market.

Bottom Up Market Sizing

You’ll hear about bottom up and top down market sizing methodologies in this article, and anywhere you read about market sizing. Let’s tackle bottoms-up first, since it’s my favorite and generally the more thoughtful of the two options. It’s called bottom-up because you are starting with the smallest bits (# of customer, # of units, average price) and building up those blocks from the bottom to form a picture of the market size.

Bottom-up market sizing is actually a very simple formula:

(A) # of Units X (B) Price = Market Size

Let’s apply this bottom-up sizing formula to our coffin example.

Bottom Up Sizing Methodology

# of Units?: 1,097,000

There are 2.8m deaths per year in the US[1] and 39% of those are burials[2]). Let’s assume loved ones are buying a single coffin for these individuals, so 1,097,000 deaths = 1,097,000 total coffins sold in a year.

What’s the Average Price?: $2,500

The average casket/coffin is “slightly more than $2,000” [3].

1,097,000 coffins X $2,500 = $2.7B USD Annually

So, our bottom-up method estimates a total US market size of $2.7B for coffins. That was easy.

Before we move on, let’s get into some minor weeds. Item A of our formula–# of Units–was simple in this case. 1 death = 1 unit/year. Great, but what about markets where the buyer doesn’t make only one purchase per year? Bubble gum might be a good example of that. In these cases, we might need to think about how many buyers exist X the # of units/buyer/year in order to get to our estimate of the # of Units.

Let’s dig into pricing (Part B of our formula) a little deeper as well. In our example, one average price was used to size the overall market. That’s great, but what if you are selling more than one model of the product at different prices to different segments of the market? In the case of the market for coffins, let’s look at the following (fictional) market segmentation. We’ve split the market into limited income, middle income, and high income markets, each with a different willingness to pay. We could create market sizings for each segment, but in our example we are looking at the market as a whole and therefore used the weighted average price of $2,500/coffin. Market segmentation is worthy of a post of its own later.

Top Down Market Sizing

OK, now that we have bottom-up sizing figured out, let’s talk about another approach called top down market sizing. With top down market sizing, you obtain an overall size of a market that includes your market (but probably more), then you apply some filters to break it down to more closely estimate the your specific market.

With top-down market sizing, Google is your friend. You might find through secondary research that an analyst somewhere has already published a market size estimate of your market (like this, or this), or a very similar market. In this case, you are conveniently handed the current total addressable market (also called total available market), or TAM. From here, you can make out some assumptions and carve out the serviceable available market (SAM) and serviceable obtainable market (SOM). More on that later.

While it is always nice to find a market size estimate like this from a 3rd party, you’ll find that your audience often wants more in-depth analysis from you!

More likely, you will find that there is a solid data available, but it represents a market that is much larger than your target, and you’ll need to apply some assumptions to widdle it down. Let’s go back to our morbid coffin example to see how this works.

Top Down Sizing Methodology

Great news! After a stellar Googling session, you find three sources saying that the “death care” industry in the US is a $14b-$20b/year market[4-6]. You take the average of $17b to be best estimate of the truth. You aren’t in the “death care” industry, though. Well, you are, but caskets only represent a small portion of that larger industry, right?

Through some additional research you estimate that approximately half (50%) of all funeral costs are burial costs, and that coffins make up 33% of the cost of a burial[7]. You are pumped to have all the pieces in place to estimate your market now.

So, 50% of $17b is $8.5b, which is your estimate of the cost of burials.

Now you apply your knowledge that 33% of burial cost are due to coffins.

$8.5b in US burials cost X 33% = $2.8b Top Down Market Size Estimate

Triangulation (Two Methods are Better than One)

In most cases, it is a worthwhile exercise to use both top down and bottom up methods to estimate your market. Once you have determined a market estimate with each, I like to present them together individually, and as an overall average.

The other benefit of using both methods is that each acts as a bit of a check and balance for one another. If you find your results are vastly different from one another, it’s a clue to think through the assumptions of each one more carefully.

It is often helpful to use multiple methodologies to determine your overall market size estimate

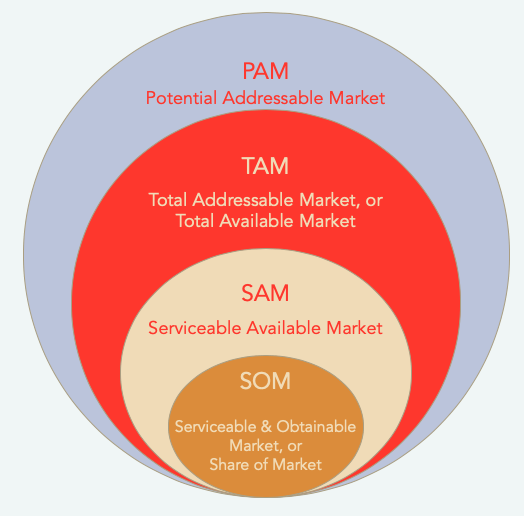

TAM, SAM, SOM

TAM, SAM, and SOM are hallmarks of market sizing, and they certainly help us to understand what we are estimating and communicating. Let’s define these terms, then we’ll get back to our example and show you how they work.

PAM = Potential Addressable Market

I know, I know. PAM isn’t even in the header of this section and you’ve probably never heard of it before. It’s rarely mentioned, but I’ve seen it used from time to time and I really like it as a concept. The key word is potential because it includes the universe of buyers not currently included in your target market, but it’s conceivable that they could be in the future. In our example of the coffin market, we are currently focused on the US market; however, if we have aspirations of global expansion, we ought to consider the entire world. Plus, we are currently only considering those who are buried and excluding all who are cremated. If we believe we can somehow influence trends and shift the entire world towards burials, the potential of all funerals may be considered in PAM. In summary, PAM is the most optimistic and forward thinking view possible. VCs will often see PAM being presented to them under the cloak of TAM.

TAM = Total Addressable Market (aka Total Available Market)

Most of the time, when people ask “what’s the size of the market?” they are asking for TAM. Most of the time, when a founder presents the market opportunity, they are presenting TAM. In both of our top-down and bottom-up examples earlier in this article, we were estimating TAM. Total Addressable Market is the total market size in your target market–remember early on how we defined our target users, buyers, and market scope? Well that’s our target market. At this point, we are not limiting ourselves to who we can reach or how many we can obtain.

SAM = Serviceable Addressable Market

While it would be awesome to reach the entire TAM, most of the time we cannot, so SAM represents the market we can actually reach with our sales team, resellers, distribution channel partners, etc. In the case of the coffin example, perhaps we only have distribution deals that cover 25% of the US market, even though we aim to reach 100% of the US market. Well, 25% of the TAM is our SAM in this case.

SOM = Share of Market (aka Serviceable and Obtainable Market)

This is the portion of the market we actually expect to capture as customers. Now we are factoring in all sorts of things, including the competitive landscape, ability to scale, and so on. In our example, we determined that we have reach into 25% of the targeted US market, but we don’t expect to win 100% of that market because competition will be fierce. Instead, we hope and expect to capture 10% of the market share, which represents our SOM.

Coffin Market Example: PAM, TAM, SAM, SOM

Let’s get back to our example of the US coffin market and see how PAM, TAM, SAM, and SOM play out there:

Summary and Conclusions

We’ve covered the process of market sizing through an example. We learned that it’s important to start by defining our market in terms of the buyer and scope (geographical, demographic, etc.). We learned how to do a top-down and bottom-up size estimate. Finally, we covered the differences between TAM, SAM, and SOM and even the super optimistic PAM. I hope this article was helpful. If you have something to add, please leave a comment below. Disagree with anything?…leave a comment below. Love it?…definitely leave a comment below.

Sources:

[1] CDC

[2] National Funeral Directors Association (NFDA)

[3] FTC

[4] The Hustle ($20b)

[5] 247WallSt ($15b)

[6] US Dept. of Commerce via Wikipedia ($14.2b)

[7] Choice Mutual (link)

-end-